If such were not the case, an entity would essentially be acquiring assets with the intention of closing its operations and reselling the assets to another party. The going concern principle is the assumption that an entity will remain in business for the foreseeable future. Conversely, this means the entity will not be forced to halt operations and liquidate its assets in the near term at what may be very low fire-sale prices. By making this assumption, the accountant is justified in deferring the recognition of certain expenses until a later period, when the entity will presumably still be in business and using its assets in the most effective manner possible.

Would you prefer to work with a financial professional remotely or in-person?

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. I have primarily audited governments, nonprofits, and small businesses for the last forty years. I have found the articles very informative and, to me, are more understandable than a lot of literature, including that released by the authorative sources, that I have read. Finally, keep in mind that going concern is also relevant to compilation and review engagements. You can specify a date in the support letter that is later than the expected date.

if (t.invoked) return void (window.console && console.error && console.error(“Drift snippet included twice.”));

You’ve heard there are new requirements for both management and auditors, but you’re not sure what they are. The concept of going concern is an underlying assumption in the preparation of financial statements, hence it is assumed that the entity has neither the intention, nor the need, to liquidate or curtail materially the scale of its operations. If management conclude that the entity has no alternative but to liquidate or curtail materially the scale of its operations, the going concern basis cannot be used and the financial statements must be prepared on a different basis (such as the ‘break-up’ basis). In our experience, if there are such material uncertainties, then the company usually provides disclosure as part of the basis of preparation note in the financial statements. In general, an auditor examines a company’s financial statements to see if it can continue as a going concern for one year following the time of an audit.

Going Concern Accounting and Auditing

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. A going concern is often good as it means a company is more likely than not to survive for the next year. When a company does not meet the going concern criteria, it means that a company may not have the resources needed to operate over the next 12 months. There are also a number of quantifiable, measurable indicators that auditors use to measure going concern.

Our Services

Previously prepared budgets may be of limited relevance when economic and business conditions are changing rapidly. They may require significant revision – e.g. for forecast sales, gross margins and changes in working capital – to be able to support management’s assessment in the unpredictable environment. After updating the forecasts, management will need to assess whether it expects to remain in compliance with financial covenants.

For example, plans that are dependent on the performance of parties outside of management’s control, such as lenders and investors and potential buyers of assets, may require new levels of negotiations and result in lower cash proceeds than previously attained. The preparation of multiple sensitivity analyses based on a variety of assumptions may be required to appropriately assess the probability of results in multiple market conditions. Management should also ensure that these assumptions are consistent with other areas of financial reporting, such as those used for estimates and impairments.

- If the net income is zero or negative, it may be better for a company not to report any figures at all.

- The going concern review can require significant judgement to be applied and the impact of external factors, such as significant global events, can make the assessment of management’s going concern review challenging.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

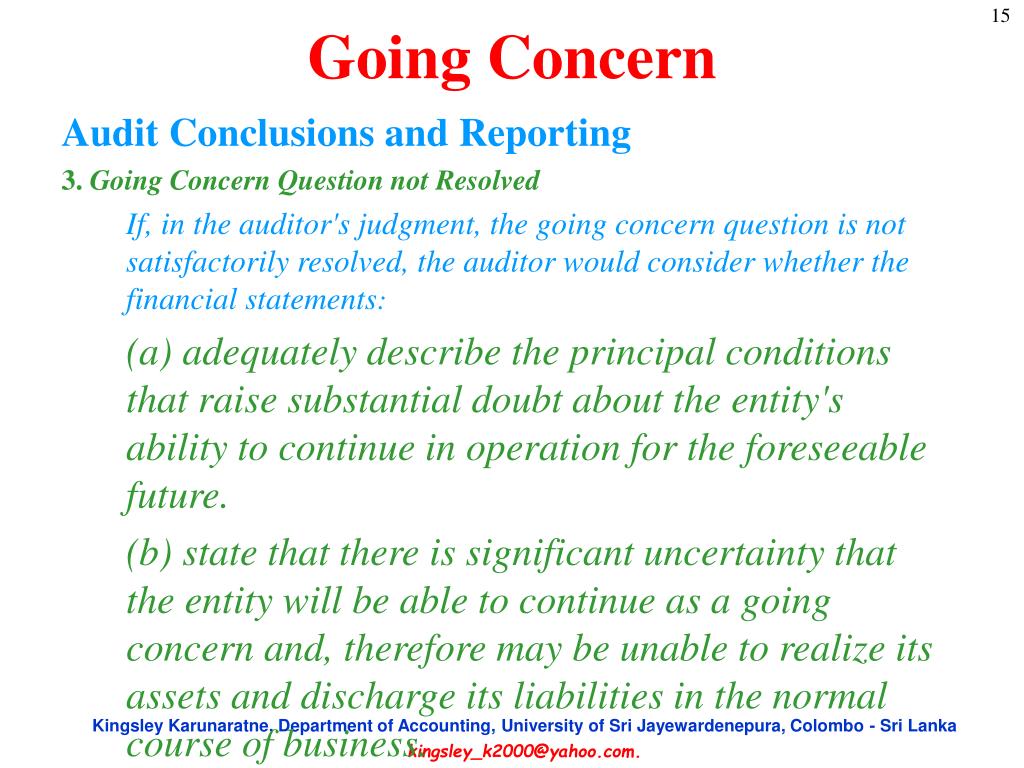

This means that the financial statements are effectively rendered meaningless, and ISA 570 requires the auditor to express an adverse opinion on the financial statements. If the auditor concludes that there is substantial doubt concerning the company’s ability to continue as a going concern, an emphasis of a matter paragraph should be added to the opinion. The going concern presumption that an entity will be able to meet its obligations when they become due is foundational to financial reporting.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. If a business has permanently closed down, the assets how to report backdoor roth in turbotax should be removed from the books and all liabilities are settled. If there are still some assets that are still in use, these must be transferred to the new owner or sold with appropriate adjustments.